Electric Vehicle Charging Station Market Size Share Analysis. Growth Trends Forecasts (2023. 2028)

The Global Electric Vehicle (EV) Charging Infrastructure Market is Segmented by Vehicle Type (Passenger Vehicles and Commercial Vehicles), Charger Type (AC Charging Station and DC Charging Station), Application Type (Public and Private), and Geography (North America, Europe, Asia-Pacific, and Rest of the World). The report offers market size and forecast in terms of value in USD billion for the above segments.

Major Players

Disclaimer: Major Players sorted in no particular order

Need a report that reflects how COVID-19 has impacted this market and its growth?

Electric Vehicle (EV) Charging Station Market Analysis

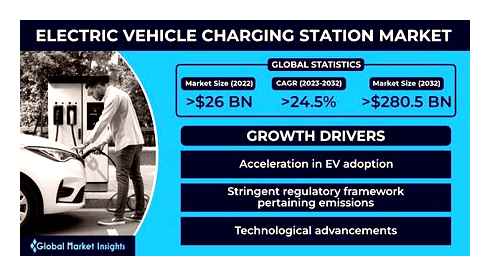

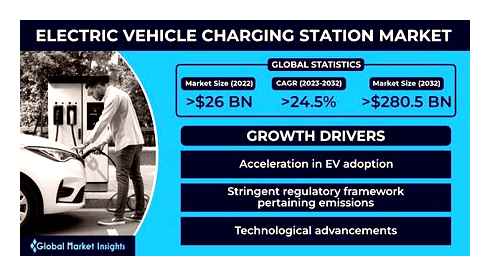

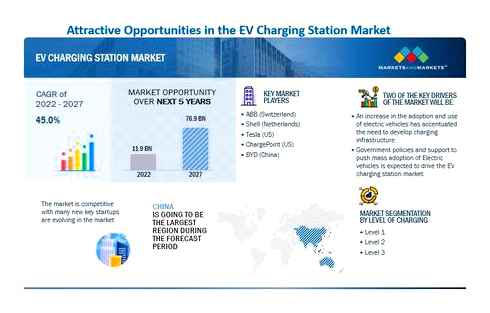

The Electric Vehicle Charging Station Market size is expected to grow from USD 26.09 billion in 2023 to USD 82.65 billion by 2028, at a CAGR of 25.94% during the forecast period (2023-2028).

The COVID-19 pandemic compelled about 95% of all automotive-related companies to put their workforces on hold during the lockdowns. Globally, the repercussions of the lockdown were immense and unprecedented due to the halt of manufacturing activities. However, the market regained its momentum as economic activities resumed and vehicle production rose worldwide. As the economies are gradually back on track, the market is likely to witness significant growth over the next five years.

Over the long term, the growth of the electric vehicle charging infrastructure can be attributed to the enactment of stringent emission and fuel economy norms, government incentives, and the increasing sales of electric vehicles, which are generating a demand for charging stations. Some prominent players are also investing in the development of electric vehicle charging stations. For instance,

- In October 2022, Octopus Energy Generation made its first investment in the UK EV charging infrastructure. It is planning to invest up to GBP 110 million in Manchester-based EV public charging network Be. EV on behalf of its Sky fund (ORI SCSp) to scale and install new charge points across the United Kingdom. The agreement will contribute to the expansion of Be.EV’s 150-strong public charge point network, with Be. EV is committing to adding 1,000 more charge points across the North of England and beyond.

The electric vehicle charging station market is witnessing various new technologies that are expected to hit the market in the coming years. Various players in the market are working on technologies such as wireless charging and autonomous charging robots, which may make vehicle charging convenient. For instance,

- In January 2021, Siemens AG launched a new high-power charger Sicharge D. It features scalable, high charging power of up to 300 kW. The charging station also supports voltages between 150 and 1,000 volts and charging currents of up to 1,000.

Europe and North American regions are expected to hold a significant share of the market, followed by the Asia-Pacific region. The growth in this region is supported by electric vehicle sales and production, coupled with the penetration of electric cars and commercial vehicles in the major countries in the region over the coming years.

Electric Vehicle (EV) Charging Station Industry Segmentation

An electric vehicle charging station, also known as an EV charging station, ECS (electronic charging station), and EVSE (electric vehicle supply equipment), supplies electric energy for the recharging or charging of plug-in electric vehicles, including electric cars, neighborhood electric vehicles, and plug-in hybrids.

The electric vehicle charging station market is segmented by vehicle type (passenger vehicles and commercial vehicles), charger type (AC charging station and DC charging station), application type (public and private), and geography (North America, Europe, Asia-Pacific, and Rest of the World). For each segment, market sizing and forecast are given on the basis of value in USD billion.

Report scope can be customized per your requirements. Click here.

Electric Vehicle (EV) Charging Station Market Trends

This section covers the major market trends shaping the EV Charging Station Market according to our research experts:

Public charging stations are leading the Electric Vehicle Charging Station Market

The availability of public EV charging stations is critical in the purchase of electric vehicles all over the world. When purchasing an electric vehicle, public charging access to fast charging is regarded as a critical criterion. This is expected to increase revenue growth in the public charging segment. Due to the growing number of EV users, the Asia Pacific region continues to install public charging stations at a Rapid pace, particularly in China, India, and South Korea. For instance,

- In October 2022, Ather Energy announced the installation of the 580th public fast charging point, the Ather Grid, across 56 cities in India. As the company expands its national footprint, Ather Energy plans to install 820 more grids, bringing the total to 1400 by the end of FY23. Ather Grids are strategically installed across markets, with 60% of current installations in tier-II and tier-III cities.

These countries are implementing policies that encourage the use of electric vehicles by providing subsidies and lowering taxes. They also promote the growth of EV manufacturers and related industries by providing grants or enacting preferential policies for EV-related businesses to allow them to expand more quickly. A steady increase in economic growth, urbanization, travel demand, and increased investments in electric mobility to contribute to energy storage and environmental sustainability are expected to fuel the growth of the public charging station segment.

Governments worldwide have introduced various schemes and initiatives to encourage buyers to choose electric vehicles over conventional vehicles.

- The California ZEV program, which aims to have 1.5 million electric vehicles on the road by 2025, is one such initiative. India, China, the United Kingdom, South Korea, France, Germany, Norway, and the Netherlands are some of the countries offering various incentives for people looking to purchase an electric vehicle.

Such developments and factors are expected to contribute to the growth of the public charging station segment.

To understand key trends, Download Sample Report

Asia-Pacific Region Likely to Play Key role in the Market

In Asia-Pacific, China is the largest market for electric cars and buses. The Chinese electric vehicle charging station market is well supported by its battery electric vehicle market, backed by generous support from the government. China extended the incentives relating to purchasing new energy vehicles (NEVs). In January 2020, Tesla Motors inaugurated a USD 2 billion facility in Shanghai, which was assembling nearly 3,000 cars per week in March 2020 when all the other global facilities of the electric vehicle giant were shut down due to the COVID-19 pandemic.

- According to the data released in August 2020 by the China Electric Charging Infrastructure Promotion, members of the Alliance reported that about 566,000 public charging stations were installed and started operations across the country by the end of July 2020. Of these, 326,000 are AC, 240,000 are DC, and 488 are equipped with AC and DC capabilities. In July 2020, the total charging power of all stations across the country reached 670 million kWh, a Y-o-Y increase of 52.4%.

The electric vehicle market in Japan is experiencing growth as the demand for emission-free vehicles increases. The government is also investing heavily in the electric vehicle market. The Japanese government aims to transform all the new cars sold in the country into electric or hybrid vehicles by 2050. The government also set a target to reduce CO2 emissions and other greenhouse gasses by about 80% per vehicle by 2050. over, the private sector companies are also taking initiatives and indulging in strategic partnerships to develop charging infrastructure. For instance,

- In November 2022, PT PLN (Persero) and PT Industri Ion Mobilitas signed a memorandum of understanding (MoU) on Electric Motor Charging Solutions and Services at the Jakarta Convention Center (JCC) in the hope of accelerating the use of Battery-Based Electric Motorized Vehicles (KBLBB) in Indonesia. The partnership will begin with 100 Public Electricity Charging Station (SPLU) units in Jakarta.

Reducing risks from electric vehicle charging infrastructure

THURSDAY, NOVEMBER 17, 2022

With electric vehicles becoming more and more common, the risks and hazards of a cyberattack on charging equipment and systems also increases. Fortunately, Jay Johnson, a Sandia electrical engineer, has been studying the varied vulnerabilities of electric vehicle charging infrastructure for the past four years.

Jay and his team recently published a summary of known electric vehicle charger vulnerabilities in the scientific journal Energies.

“By conducting this survey of electric vehicle charger vulnerabilities, we can prioritize recommendations to policymakers and notify them of what security improvements are needed by the industry,” Jay said. “The Bipartisan Infrastructure Law allocates 7.5 billion to electric vehicle charging infrastructure. As a part of this funding, the federal government is requiring states to implement physical and cybersecurity strategies. We hope our review will help prioritize hardening requirements established by the states. Our work will also help the federal government standardize best practices and mandate minimum security levels for electric vehicle chargers in the future.”

Compiling vulnerabilities

Electric vehicle charging infrastructure has several vulnerabilities ranging from skimming credit card information — just like at conventional gas pumps or ATMs — to using Cloud servers to hijack an entire electric vehicle charger network.

The Sandia researchers are working with experts from Argonne, Idaho and Pacific Northwest national laboratories; the National Renewable Energy Laboratory; and others as a national security laboratories team.

“We are focused on larger impacts to critical infrastructure as we electrify more of the transportation industry,” Jay said. “We have been studying potential impacts to the power grid. Also, as law enforcement and other government agencies consider switching to electric vehicles, we’ve been thinking about how the inability to charge vehicles could impact operations.”

Brian Wright, a Sandia cybersecurity expert on the project, agreed about the scale of the challenge.

“We don’t want bad things to happen to the grid, and we want to keep electric vehicle drivers safe and protect people working on the equipment,” Brian said. “Can the grid be affected by electric vehicle charging equipment? Absolutely. Would that be a challenging attack to pull off? Yes. It is within the realm of what bad guys could and would do in the next 10 to 15 years. That’s why we need to get ahead of curve in solving these issues.”

The team looked at a few entry points, including vehicle-to-charger connections, wireless communications, electric vehicle operator interfaces, Cloud services and charger maintenance ports. They looked at conventional AC chargers, DC fast chargers and extreme fast chargers.

The survey noted several vulnerabilities on each interface. For example, vehicle-to-charger communications could be intercepted and charging sessions terminated from more than 50 yards away. Electric vehicle owner interfaces were chiefly vulnerable to skimming of private information or changing charger pricing. Most electric vehicle chargers use firewalls to keep separate from the internet for protection, but Argonne National Laboratory researchers found some systems did not. Additionally, an Idaho National Laboratory team found some systems were vulnerable to malicious firmware updates.

The multilab team found many reports of charger Wi-Fi, USB or Ethernet maintenance ports allowing reconfiguration of the system. Local access could allow hackers to jump from one charger to the whole charger network through the Cloud, Jay said.

Patches and next steps

In the paper, the team proposed several fixes and changes that would make the U.S. electric vehicle charging infrastructure less vulnerable to exploitation.

These proposed fixes include strengthening electric vehicle owner authentication and authorization such as with a Plug-and-Charge public key infrastructure, Jay said. They also recommended removing unused charger access ports and services and adding alarms or alerts to notify charger companies when changes are made to the charger, like if the charger cabinet is opened. For the Cloud, they recommended adding network-based intrusion detection systems and code signing firmware updates to prove that an update is authentic and unmodified before being installed. Sandia has produced a best-practices document for the charging industry.

Now that this review has been completed, the Sandia team has received follow-on funding to tackle some of these gaps. They are working with Idaho and Pacific Northwest national laboratories to develop a system for electric vehicle chargers. This system will use cyber-physical data to prevent bad guys from impacting the electric vehicle charging infrastructure.

The team has another research project that involves evaluating public key infrastructures for electric vehicle charging, providing hardening recommendations for charging infrastructure network owners, developing electric vehicle charging cybersecurity training programs and assessing the risk of the various vulnerabilities. Risk analysis looks at both the likelihood of something bad happening and the severity of that bad thing to determine which changes would be the most impactful.

“The government can say ‘produce secure electric vehicle chargers,’ but budget-oriented companies don’t always choose the most cybersecure implementations,” Brian said. “Instead, the government can directly support the industry by providing fixes, advisories, standards and best practices. It’s impossible to create solutions if you don’t understand the state of the industry. That’s where our project comes in; we did the research to find where we are and what gaps would be the quickest and most impactful to fix.”

This work was supported by the DOE Vehicle Technologies Office and the Office of Cybersecurity, Energy Security and Emergency Response.

Problem 2: Inconsistency of Experience

Inconsistencies apply to EV charging across the board. The first is the hardware, the connectors themselves. Level 1 and Level 2 chargers, which use wall plugs that can be found in homes, use a standard connector that works across all EVs except Tesla. However, Level 3 chargers, which provide the convenience of fast charging and are increasingly being deployed in public charging spaces, use three different standards.

Manufacturers have therefore developed a range of different charging connectors for their vehicles.

Tesla has a unique connector for use with the Tesla Supercharger Network, and it comes with an adapter for use with other charging stations. Many Japanese manufacturers use a different connector than the ones used by U.S. and European manufacturers. Depending on the model of car an EV driver has, they may find fewer compatible charging stations in their local area and along planned routes.

Once the right connector is found, other issues are common. Consider this list of items outlined by CPO EVgo as “common foibles.”

- Not plugging the connector fully into the EV charging port (no click sound)

- Thinking the connector is stuck, but it just needs a little more elbow grease

- A CHAdeMO connector not seated fully into a Tesla adapter

Beyond hardware, further inconsistencies apply as different charging stations offer different customer experiences. Payment methods, for example, vary and cause friction. Many CPOs require the driver to download an app and will then ask for payment in-app. Others run on a membership model. Sometimes a program charging card is used where the card swipe does not work.

When drivers download apps, they may be of varying quality, with some crashing frequently and loading slowly. This inconsistency and frustrating customer experience can add unprecedented time and challenge to an EV driver’s day.

Fixing Issues to Improve the Customer Experience

Resolving these problems within the EV charging experience requires viewing them through a customer service lens. CPOs can then begin implementing technology and solutions that make the entire process seamless. The driver experience can be enhanced by CPOs fixing chargers quickly when they malfunction, enabling simpler authentication and billing methods and providing convenient support to customers.

Answering this question starts with reliable connectivity to and from chargers. Companies such as Twilio offer specialized cellular SIM cards that provide multi-carrier connectivity.

While Wi-Fi can be cost-effective in home environments, cellular has many advantages related to availability (relative ubiquity of signal outdoors), simplicity (no access points to manage), and security (less prone to hacking). Once chargers are reliably connected via cellular, they can benefit from features such as:

- Remote monitoring for issues or abnormalities by analyzing sensor data coming from a charger

- Receiving software updates and security patches in real time

- Connecting with user accounts and creating more seamless payment processes

- Connecting drivers directly to on-screen tutorials or contact centers leveraging VoIP technology

- Displaying advertising from sponsors, creating more revenue for CPOs

Reliable connectivity is not the panacea, however. Physical problems will still exist with chargers that can’t be detected from remote sensor readings and progress toward a universal charging connector standard may never materialize.

The ability for drivers to plug an electric vehicle into a charging station without additional authorization using an RFID card or mobile app using Plug Charge (part of ISO 15118) will be important to removing friction as it becomes more commonplace outside of the Tesla network. And services like Twilio Verify can enable “silent” network authentication, so authenticating CPO user accounts on mobile apps can be made easier.

With electric vehicles, refueling shifts from a transactional relationship — find the corner gas station, insert credit card, to a relationship with a service provider — involving a user account, wayfinding, charger availability, charge status, and nearby amenities. Even with the hardware enhancements mentioned above, customer service will be a critical factor in customer satisfaction. Forward-thinking CPOs with offer an omnichannel customer service experience that might involve a button to reach a contact center from the charger directly or communicating over text or WhatsApp for service, and they will leverage first-party customer data to provide a personalized experience, for example, using a customer’s historical charging locations and times to notify customers of charger availability and provide redirects to alternate nearby locations without a wait.

As more publicly accessible chargers are installed globally, CPOs must deliver a convenient and reliable customer experience to meet customer expectations. The industry is dynamic and fast-paced. The CPOs who deliver the most seamless customer experience will emerge as the winners.

About the Author

Jon Asmussen has 20 years of experience in wireless telecommunications and software in roles spanning business development, sales, and product management. For over 10 years he has been focused on helping businesses achieve operational efficiencies leveraging IoT technologies. As head of business development for Twilio IoT, he is responsible for partnerships, channels, and market development. To hear more from Jon, follow him on LinkedIn.

The EV Report

The EV Report is a digital platform dedicated to the global electric vehicle industry. It is a product of Hagman Media Group, and its mission is to inform, engage, and connect industry professionals and EV enthusiasts with relevant news and insights.

Level of Charging Insights

The level 2 charging segment dominated the market and accounted for a share of more than 52.0% of the global revenue in 2022. Level 2 charging provides a middle ground in terms of cost and charging speed as it charges at a faster speed than level 1 chargers, and is less costly as compared to level 3 chargers. According to the data published by the International Energy Agency, there are over 104.8 thousand level 2 chargers in the U.S., out of which 89% are at public locations, 16% are at highway locations, and 5% are at interstate locations. The growing adoption of level 2 charging can be attributed to its lower costs and fast charging capabilities. over, level 2 charging systems operate based on battery capacity, and the state of its charge, which extends the vehicle range, driving its adoptions. Such features are expected to drive the market’s growth over the forecast period.

Level 3 charging is expected to register the fastest growth over the forecast period. As of December 2022, level 3 chargers are the fastest electric car chargers available for EVs. Level 3 chargers can provide an average of 100 miles of charge per hour by utilizing a 480-volt higher direct current. Since the level 3 charger has a fast charging capacity, it reduces waiting time for electric vehicle users. over, having a robust network of level 3 chargers will lead to a larger range and lower range anxiety for drivers, which is expected to drive the adoption of level 3 charging.

Connectivity Insights

The non-connected charging stations segment dominated the market and accounted for a share of more than 81.0% of the global revenue in 2022. Non-connected charging solutions are also known as non-networked or stand-alone charging solutions. Without the bother of ongoing fees associated with a charging network, non-connected charging options provide consumers with safe and secure charging options.

Consumers can pay for the charging facilities on a per-user basis with non-connected charging systems, which replicate the user experience of conventional fuel pumps. Some of the non-connected charging solutions combine their hardware with software platforms so that users may access comprehensive diagnostic information and keep track of the health of their chargers. Additionally, since there are no activation or other ongoing networking fees, non-connected chargers have reduced initial and ongoing costs. Low infrastructure costs for owners and hassle-free charging experience for consumers are expected to drive the segment’s growth.

The connected charging stations segment is expected to register the highest CAGR over the forecast period. A network charger, often known as a connected charging solution, is a charging network that is controlled by network software. Electric vehicles are equipped with features that are beneficial to hosts and drivers. Site hosts, for example, can gain network access features like remote administration, advanced analytics, energy management capabilities, and round-the-clock customer assistance, while drivers can access it for a variety of uses, including location and reservation via applications. These characteristics will become increasingly important as the number of drivers of electric vehicles rises over the next years, which is anticipated to drive the adoption of connected charging solutions over the forecast period.

Application Insights

The residential segment dominated the market and accounted for a revenue share of more than 85.0% of the global revenue in 2022. The residential segment is further bifurcated into private houses and apartments. Electric vehicle chargers for residential spaces can also offer significant growth potential as they provide a cheaper and more convenient mode for charging electric vehicles as compared to commercial charging stations. Since users prefer charging their vehicles at home owing to ease and convenience, they opt for AC charging stations for EVs, as the cost of installation is reasonably low compared to DC charging stations. Hence, DC charging stations have a lower adoption rate in the residential segment due to the significant costs involved in their installation.

The commercial application segment is the fastest-growing segment and is anticipated to register a higher revenue share by 2030. The commercial segment is further bifurcated into destination charging stations, highway charging stations, bus charging stations, fleet charging stations, and other charging stations. Favorable government initiatives to deploy charging stations on highway projects such as the Trans-Canada highway project, Norway to Italy Electric Highway, are driving the growth of the segment.

Several automotive companies are focused on launching new EV charging projects that would help commercial customers to go electric. For instance, in December 2021, Ford, an automotive company, announced the launch of a new EV project called Ford Pro Charging to help its commercial customers switch to electric vehicles and offer the necessary hardware and software required for charging electric vehicles.

Key Companies Market Share Insights

In October 2020, Redwood Residential and Redwood Capital Group, a Chicago-based real estate company, announced the installation of an electric vehicle charging station of SemaConnect Inc. at Deer Park Crossing Apartments. Thus, the rising enhancements in electric vehicle chargers are propelling market growth.

over, in August 2020, the Venture Port district announced the installation of five new SemaConnect Inc. charging stations for visitors to Venture Harbor. At the same time, the Series 6 charging stations are designed to replace the old pair of charging stations at Island Packers, which will be opened for all plug EV drivers at the harbor.

Acquisition and partnerships are undertaken by companies to expand their geographic presence in key markets. For instance, in November 2020, ChargePoint, Inc. announced its partnership with Volvo Car USA LLC to provide a seamless charging experience to Volvo car drivers. ChargePoint, Inc. will offer Home Flex home chargers to Volvo Car drivers. This partnership will enable drivers to charge their cars at home. Some prominent players in the U.S. electric vehicle charging infrastructure market include:

- ChargePoint, Inc.

- Leviton Manufacturing Co., Inc.

- SemaConnect, Inc.

- Tesla, Inc.

- ClipperCreek, Inc.

- General Electric Company

- Delta Electronics, Inc

- Webasto Group

- ABB Ltd.

- bp pulse